2025 Long Island Housing Market Recap: What It Means for 2026

2025 Long Island Housing Market Recap: What It Means for 2026

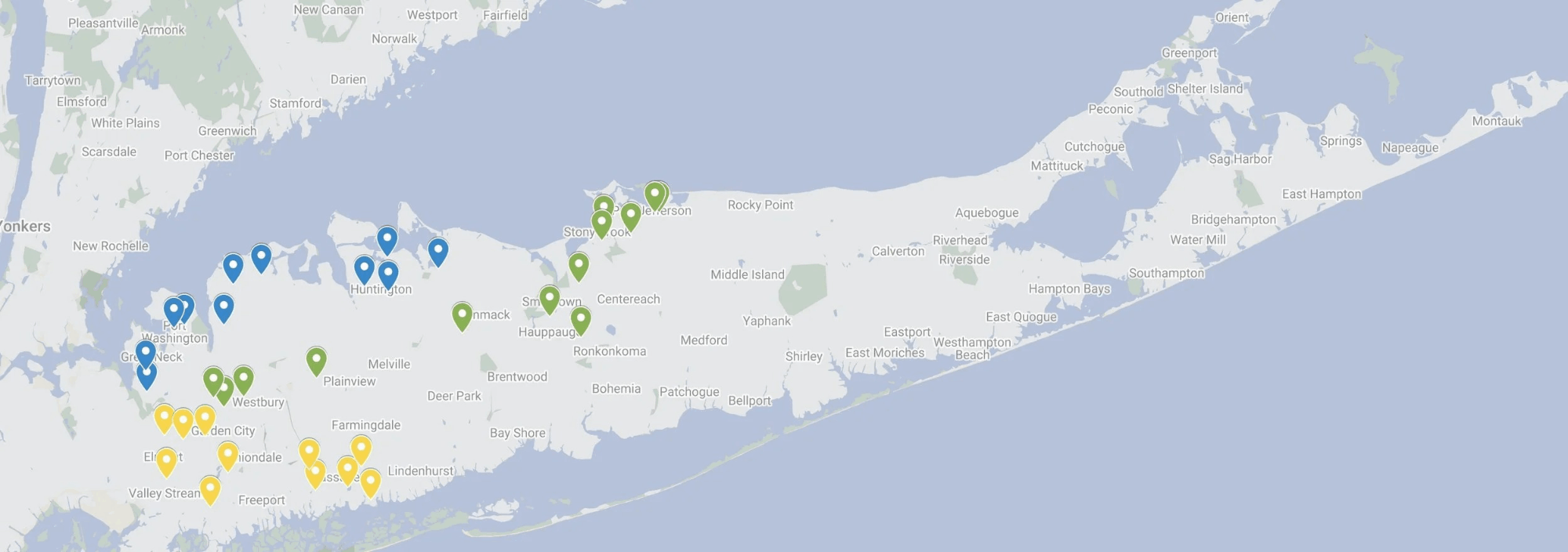

As 2025 comes to a close, the Long Island housing market continues to be shaped by low inventory, strong demand, and gradually easing mortgage rates. Nassau and Suffolk Counties have both seen home prices hold near record levels this year, even as monthly numbers fluctuated along the way.

This year-end recap gives you a clear, data-driven overview of how the market performed in 2025 – and what buyers, sellers, and investors should be thinking about as we head into 2026.

2025 at a Glance: Prices, Sales, and Inventory

Throughout 2025, home prices on Long Island remained historically high. Nassau and Suffolk both saw year-over-year price growth compared to 2024, with several months setting or matching record median sale prices. At the same time, the number of homes for sale stayed well below pre-2020 levels, keeping competition strong for well-positioned listings.

By late 2025, monthly reports showed:

- Median sale prices in both Nassau and Suffolk Counties tracking above 2024 levels.

- Inventory remaining tight across most price ranges and property types.

- Sales activity improving in some months as mortgage rates began to ease slightly.

Overall, 2025 can best be described as a market that still favored prepared sellers, while serious buyers adjusted expectations and strategies in response to higher prices and limited choices.

For more detail on monthly statistics, you can review the regional reports from OneKey® MLS and Long Island Board of REALTORS® .

Nassau and Suffolk in 2025: High Prices, Limited Supply

While Nassau and Suffolk Counties each have their own micro-markets, they shared a few key trends this year: elevated prices, low inventory, and steady demand for well-presented homes in desirable locations.

Through much of 2025, Nassau County’s median single-family home price remained higher than Suffolk’s, reflecting its closer proximity to New York City and long-established demand. Suffolk County, meanwhile, continued to attract buyers looking for more space or specific lifestyle features, while still seeing strong price appreciation of its own.

Rather than focusing on which county is “better,” buyers are best served by comparing:

- Total monthly budget (including taxes, insurance, and commuting costs)

- Desired home type and lot size

- Commute patterns and access to major roadways or LIRR stations

- Proximity to amenities, parks, and local services

For a broader cost overview, you can also refer to the Cost of Living on Long Island guide .

Inventory and Days on Market: Still a Seller-Leaning Market

Low inventory has been the defining feature of the Long Island market since 2020, and 2025 continued that trend. While there were modest improvements in new listings during some months, the total number of homes for sale remained below long-term norms.

In practical terms, that meant:

- Well-priced homes in move-in-ready condition often attracted strong interest quickly.

- Overpriced or poorly presented homes tended to sit longer and sometimes required reductions.

- Buyers who were flexible on timing, location, or features had more options to consider.

As always, the “average” story only goes so far. Days on market and showing activity can vary widely from one neighborhood and price bracket to another.

Mortgage Rates and Affordability in 2025

Higher mortgage rates were a major factor early in 2025, affecting monthly payments and buyer affordability. As the year went on, rates showed signs of easing, which helped bring some buyers back into the market and supported steady price levels.

For buyers planning a 2026 purchase, the key takeaway is that small changes in interest rates can meaningfully impact your budget. Getting pre-approved early and revisiting that pre-approval if rates move is one of the most practical steps you can take.

For more relocation context, see 10 Things to Know Before Moving to Long Island .

What 2025 Means for 2026 Buyers

For buyers, the 2025 market reinforced a few clear lessons:

- Preparation matters: Getting fully pre-approved and understanding your numbers puts you in a stronger position when the right home appears.

- Flexibility helps: Being open to different neighborhoods, property types, or timing can open up more opportunities.

- Value is local: The “right price” for a home depends heavily on its specific location, condition, and competition – not just general headlines.

If you’re planning to buy in 2026, this winter is an ideal time to review your budget, explore financing options, and start comparing towns so you can move quickly when the right property hits the market.

What 2025 Means for 2026 Sellers

For sellers, 2025 confirmed that well-prepared homes in the right price range can still perform very well – especially in areas with limited competition. However, buyers are more price- and payment-conscious than they were a few years ago, which makes accurate pricing and strong presentation more important than ever.

If you’re considering selling in 2026, think about:

- Reviewing recent comparable sales in your neighborhood.

- Addressing deferred maintenance or obvious condition issues.

- Discussing timing, pricing, and marketing strategy well before you list.

For a deeper dive on timing, you can also read How to Time Your Long Island Home Sale for 2026 .

What 2025 Signaled for Long Island Investors

Investors watching Long Island in 2025 saw a market characterized by steady demand, limited supply, and strong pricing – conditions that can support long-term equity growth, while also requiring careful deal analysis.

For buy-and-hold investors, the focus has been on stable locations, realistic rent projections, and conservative assumptions about future appreciation. For those interested in renovation or flip projects, accurate after-repair value (ARV) estimates and realistic timelines are critical.

If you’re considering an investment purchase in 2026, a detailed, property-by-property analysis is far more useful than relying on general headlines alone.

Planning Your 2026 Move on Long Island?

Whether you’re planning to buy, sell, or invest in Nassau or Suffolk County, understanding what happened in 2025 is the first step. The next step is getting a personalized look at your specific town, price range, and property type so you can make confident decisions in 2026.

If you’d like a custom breakdown of your neighborhood or a strategy session tailored to your goals, I’m here to help you navigate the numbers and the nuance – from first conversation to closing table. Let’s get you moved.

Categories

- All Blogs (68)

- Baby Boomers (5)

- Beaches (8)

- Demographics (1)

- Distressed Properties (1)

- Down Payments (4)

- Featured (5)

- First Time Home Buyers (16)

- For Buyers (37)

- For Sellers (30)

- Foreclosures (1)

- Generation X (4)

- Golf (1)

- Holidays (3)

- Holidays on Long Island (1)

- Home Preparation (1)

- Housing Market Updates (11)

- Infographic (4)

- Interest Rates (5)

- Lifestyle (21)

- Local Attractions (18)

- Long Island Living (8)

- Market Insights (1)

- Move-Up Buyers (18)

- Neighborhood Guide (1)

- New Construction (2)

- Outdoor & Recreation (1)

- Pricing (13)

- Relocation Guide (6)

- Rent vs. Buy (6)

- Selling Myths (9)

- Senior Market (3)

- Things to Do (11)

- Western Suffolk Neighborhoods (1)

Recent Posts

R.E. Associate Broker | License ID: 10301221652

+1(631) 257-1522 | kenville@listingsoflongisland.com