After selling countless homes over the past 10 years of combined experience there is ONE thing that is ALWAYS surprising to our clients.

Buyers and sellers of all price ranges and backgrounds often underestimate the total amount of interest they pay to the bank. Since they hear "rates are around 3.75-4% on a 30 year fixed they think they'll wind up paying a small amount in total interest.

The total effective interest on a 30 year fixed at 4% is actually closer to 75%. And if you only live in your home for 7-9 years like most people the total effective rate is closer to 90%!

So, if you want to have more money for the most important things in life like...

The total effective interest on a 30 year fixed at 4% is actually closer to 75%. And if you only live in your home for 7-9 years like most people the total effective rate is closer to 90%!

So, if you want to have more money for the most important things in life like...

Retirement

College Tuition

Vacations

Delicious Food

Nicer Home in Better Neighborhood

Clean New Cars

Social Clubs & Memberships

College Tuition

Vacations

Delicious Food

Nicer Home in Better Neighborhood

Clean New Cars

Social Clubs & Memberships

Then reducing your total interest expense is one of the fastest ways to do it.

We're not trying to throw loan officers and banks under the proverbial bus, we're just pointing out that the 30 year fixed conventional mortgage was created back in the 1930s with the help of Franklin D Roosevelt.

We're not trying to throw loan officers and banks under the proverbial bus, we're just pointing out that the 30 year fixed conventional mortgage was created back in the 1930s with the help of Franklin D Roosevelt.

Yet, 1.3 million home owners in the United States (and millions more around the world) are using this strategy to maximize their net worth by dramatically reducing their interest costs.

It isn't the INTEREST RATE that Impacts Your Financial Future as Much as it is the Total Amount of Interest.

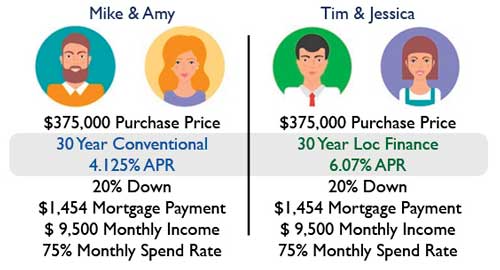

Let's look at an example of two couples with the same income, same purchase price, and same monthly mortgage expense to help demonstrate how banks are great at separating you from your money.

It isn't the INTEREST RATE that Impacts Your Financial Future as Much as it is the Total Amount of Interest.

Let's look at an example of two couples with the same income, same purchase price, and same monthly mortgage expense to help demonstrate how banks are great at separating you from your money.

.....

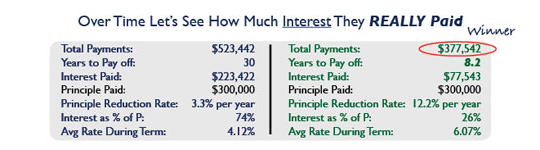

That's a $145,900 difference...an advantage ANY sane person wants.

We just showed you how two couples who paid the exact same price for a home, had a $145,900 difference in total costs. The couples in the example had the SAME income, SAME monthly payment, SAME monthly expense ratio...yet the couple who paid 6.07% interest vs 4.12% came out ahead.

Mind-bending math isn't it? That's the power of compound interest!

The difference in the total interest as a percentage of principle in this example is 48% that's a huge saving!

Don't think for a second that a bank or loan officer is going to show you how to do this. In fact, the vast majority of them don't even know-how (plus the commissions on these products are lower so they're not motivated to save you money).

Let's dig deeper and see why the numbers are so drastically different.

With a convention 30 year fixed the interest compounds daily, it's paid monthly, and the loan is closed-ended.

By using a 30 year loc the interest is still compounded daily, but the principle is PAID first daily, and the loan is open-ended.

With real estate, it is so easy to get sucked into the gorgeous houses, groupthink, etc. It can draw you away from clear logic and math-based decision-making. Most people spend 97% of their time hunting for their home and pay very little attention to the numbers behind the curtain.

When you start thinking about a nice kitchen like this it gets your mind off track.

Our job as agents is to put our 15 years of combined experience to work for you, we help our clients see through the hype and financial smoke and mirrors.

Let's get back on track and learn a little bit more about how these financing options differ.

Ask yourself, over the past 12 months how much interest have you earned in your checking account?

If you are like most people your checking account probably earns you a free coffee per year. So you're going backward 2-4% per year on inflation BEFORE you start paying interest or principal at 75-90% no wonder it is so hard for most homeowners to build equity.

Even worse, if you make extra payments on your conventional 30 year fixed that money is tied up in a closed-ended loan and very difficult to access without refinancing (which is costly and re-sets the loan term).

But there is an alternative, by combining your checking with a 30 year line of credit (loc) you can use your standing cash balance in your checking to offset the mortgage principal balance.

Another huge benefit of doing this is that you don't have to make extra payments above your standard mortgage payment to really start paying off your loan faster.

Each day we help our clients with a wide variety of scenarios from timing 1031 exchanges. Moving across the country, evicting a troublesome tenant, targeting an affluent audience for their luxury property, and a million other things you won't see on any TV show about real estate.

So what about you? Did you know about this financing strategy? Do you think our experience could help you during your real estate transaction?

Why don't we do this? Let's plan a quick 15 minute meeting over coffee (or simply over the phone if you aren't local) and we'll chat. No pressure or obligation.

Just fill out the little form below and we'll call you at your selected time. Fair enough?

Please schedule your coffee or call below